Fraud Cheats Steal £190bn a Year

Fraud Cheats Make £190bn a Year

Is it possible that Baroness Mone and Husband’s £60 million profit from a £200 million contract, although eye-watering, may not be fraudulent or criminal? Time will tell. However, their £60 million profit is microscopic compared to the potential losses caused by uninvestigated fraud and error, a fact known to the UK Government for years.

Why Austerity?

Would Austerity have been justified at all if reported fraud had been investigated and dealt with over the years? No. The issue was raised by the Public Accounts Committee time and again for many years, with no apparent interest from the government. A smokescreen (see below) suggests identifying a reported £74 million is huge and amazing, but it isn’t. Think £190 billion! Yes, £190 billion. Now there’s a number.

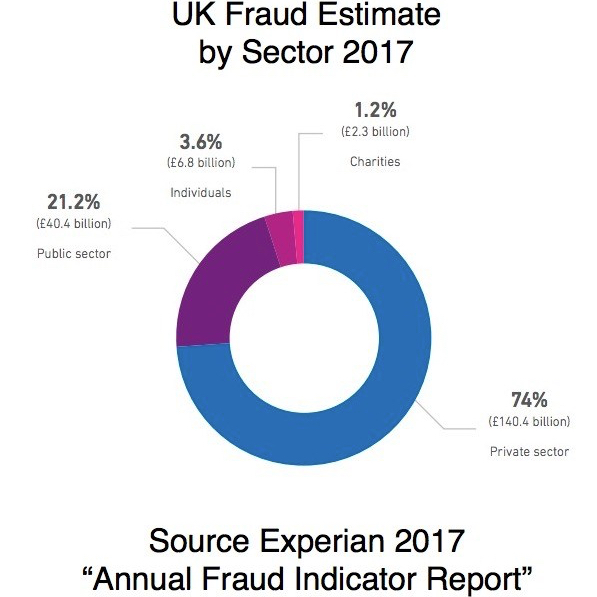

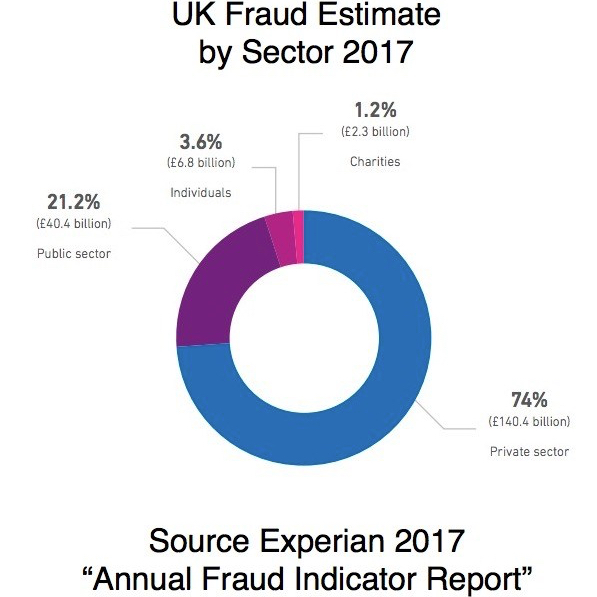

£190 billion was reportedly stolen from us and not investigated. For years, our governments have deceitfully ignored the fraud gnawing at the heart of the UK, wrecking our country’s prosperity and financial security. Says who? Experian, that’s who, in their Annual Fraud Indicator Report 2017 (download a copy).

The Tip of the Fraud and Error Iceberg—Benefits Claimants

Unsurprisingly, benefit fraud was in the crosshairs. The latest figures indicated that £3.8 billion was overpaid to benefits claimants. Roughly half that figure was thought to be in ‘error’, leaving an estimated £2bn lost to fraud. However, that only represents 1% of the losses due to fraud and error reported UK-wide in 2017. What about the rest? The big bucks.

Investigate, of course, Maximum Effort

In 2018 4,045 DWP staff investigated ‘Fraud and Error’, aiming to recover £2 billion lost to benefits fraud. Of course, IT systems supporting controls like Universal Credit aim to ensure proper management. By 2015 the IT system’s costs had reached nearly £16 billion. That’s eight times the cost of the potential fraud. Then, of course, one might wonder about how stringent the investigation of the £35bn lost tax (50% thought to be fraud) might have been.

The Fraud Iceberg

Naturally enough, you may wonder, what else should be pursued? The short answer is ‘lots.’ With this in mind, Experian’s Annual Fraud Indicator Reports are worth a look.

In their significant and credible research, Experian and partners calculated that fraud accounts for up to £190 billion per annum lost to the UK purse. Imagine the difference recovering £40 billion annually would make to UK finances every year. What about the other £150bn?

Furthermore, the annual scale of losses has been raised for years. The need for a criminal investigation into this industrial-scale abuse appears to be routinely ignored.

Back in 2014, the UK Commons Public Accounts Committee accused the government of a deliberate cover-up of fraud and error. Is the failure to investigate deliberate? Of course, the UK government needs the determination to do it. At last, in 2023, it seems the surface is being scratched.

Government Misleads on Scale of Fraud and Error

Here is an example of covering up the true and reported scale of mischief:

“Attempts at fraud will happen and government sees the identification of these problems as a great success. It is only through identifying and understanding fraud that we can take effective action against it. We have made good progress, since 2014/15, identified fraud in the public sector has risen from £29.7 million to £73.6million. This rise has been due to the hard work of public sector workers and the coordinated drive from the Cabinet Office.” Chris Skidmore (then Minister for the Constitution)

Minister Skidmore reported that his team identified £74 million of fraud through hard work. In other words, there is only at least £39.9 billion to go—every year—if the figures can be believed!

As the Minister said:

“This Government’s ambition is for the UK public sector to be one of the leading countries in both identifying and dealing with fraud loss and risk. The Cabinet Office is bringing government together to move on this agenda.”

In light of other facts in documents such as the Annual Fraud Indicator reports, could it be that our leaders lack interest or are generally unwilling to pursue criminality? Are key politicians complicit?

There’s More, Much, Much More

In 2016, our government estimated between £22 and £49 billion were lost annually due to fraud in the public sector. [You may note that the original link destination was removed (airbrushed?) by reorganisation in 2022]. Nevertheless, with such significant amounts in mind, crowing about identifying £74 million of fraud and error is crass. This ‘excellent’ assertion was somewhat misleading (fraudulent?) compared to the scale of things.

The Biggie

As mentioned above, we have the UK Annual Fraud Indicator (AFI) 2017. It reports that such criminality costs our country £190 billion a year. Why did the Government Fraud Landscape Annual Report 2018 report much lower amounts of money? Despite the Experian report, the government suggested a figure of £191 million as the tip of the iceberg. That is one-thousandth of the Experian total estimate.

Recover the money!

If £130 million a year is spent recovering (or at least trying to recover) £4 billion of benefit losses, wouldn’t a similar effort to recover the rest make sense? Imagine similar resources being applied. It’s worth remembering that even if we only recovered a third of the money, that would be £60+ billion. Why are we facing more Austerity?

One thing is clear: over the last ten years, if the Annual Fraud Indicator figures are correct, up to ten times the annual reported losses, or £1,900 billion (give or take), have been lost to fraud and incompetence.

Disgrace

Here we are, in a wealthy country with food banks where 30% of our children live in relative poverty. At the same time, do fraudsters smear their bodies with suncream, sip a glass of bubbly and languish on their yachts?

Are you concerned? Dissembling and incompetence muddy the water, misleading us all about the scale and insidiousness of the fraud and error problem. It’s time to act, prosecute and imprison.

© Mac Logan

10 thoughts on “Fraud Cheats Steal £190bn a Year”